How is NDIS transport managed?

How does General Transport funding work under the NDIS?

How does Activity Based Transport (ABT) funding work?

What is Provider Travel and how does it work?

Can Activity Based Transport be used when a participant receives transport funding?

Can I used NDIS funding for a sex worker?

Will the NDIS pay for an air conditioner?

Can a wheelchair be funded by an NDIS Plan?

Does the NDIS cover prescription glasses?

Can the NDIS cover subscription streaming services like Netflix and Disney+?

Can massage be claimed under the NDIS?

Will the NDIS pay for a vacuum cleaner?

Are swimming lessons covered by the NDIS?

Will the NDIS pay for a fridge or other household items?

Will the NDIS fund music lessons?

Can NDIS funds cover music therapy?

Is insurance for a wheelchair or scooter covered?

Will the NDIS fund a Thermomix?

Can I claim gardening, cleaning and maintenance under my child’s NDIS plan?

Can I use NDIS funding to employ a tutor for my child?

Psychosocial Plans & funding under NDIS

My dog is my support, can I pay for boarding costs & vet bills?

Can I purchase a weighted blanket?

Can I use my child’s NDIS funding for an Autism Spectrum Disorder Assessment?

Is a functional assessment covered under my NDIS Plan?

Can I purchase a bean bag or sensory chair?

Is parent/carer training funded under my child’s NDIS plan?

Can I use my funding to pay for music/dance lessons/art classes/yoga classes?

Are gym memberships funded under my plan?

Can I have meals delivered/prepared under my NDIS funding?

Can a support worker’s theatre ticket be paid for with NDIS funding?

Can I buy a mattress with my low cost AT funding?

Can I use my core funding for builder’s quotes?

Can I purchase gym / therapy equipment my PT / OT has recommended?

Can I use my funding for self-paced therapy kits?

Do I need to take out insurance to insure carers?

Is equine therapy covered under my NDIS plan?

Can a support worker help me to engage in recreational horse riding?

If my activity is with a disability specific group or centre is it funded?

I have an assistance animal, can I claim pet insurance?

Can I buy a pet or companion animal with my funding?

Can I have driving lessons funded?

Is gaming therapy covered under my NDIS plan?

Is yoga therapy covered under my NDIS plan?

Can I buy a disability specific bicycle with NDIS funding?

Are modified fluids and thickeners NDIS supports?

Are dietetics/dietitians NDIS supports?

Is STA available for participants in Supported Independent Living or living alone?

Does STA cover the cost of transport?

Does the NDIS fund groceries or fast food?

Does the NDIS fund dietary supplements?

What can be funded if a client has dysphagia?

Can the NDIS fund meal preparation or delivery services?

What if my support worker is unavailable to help with meal prep or I live in a rural area?

What are flexible and stated supports?

How are decisions about meal preparation supports made, and what evidence is needed?

Are parenting programs funded by the NDIS?

What early intervention or developmental delay supports are available to children and their parents?

How is NDIS transport managed?

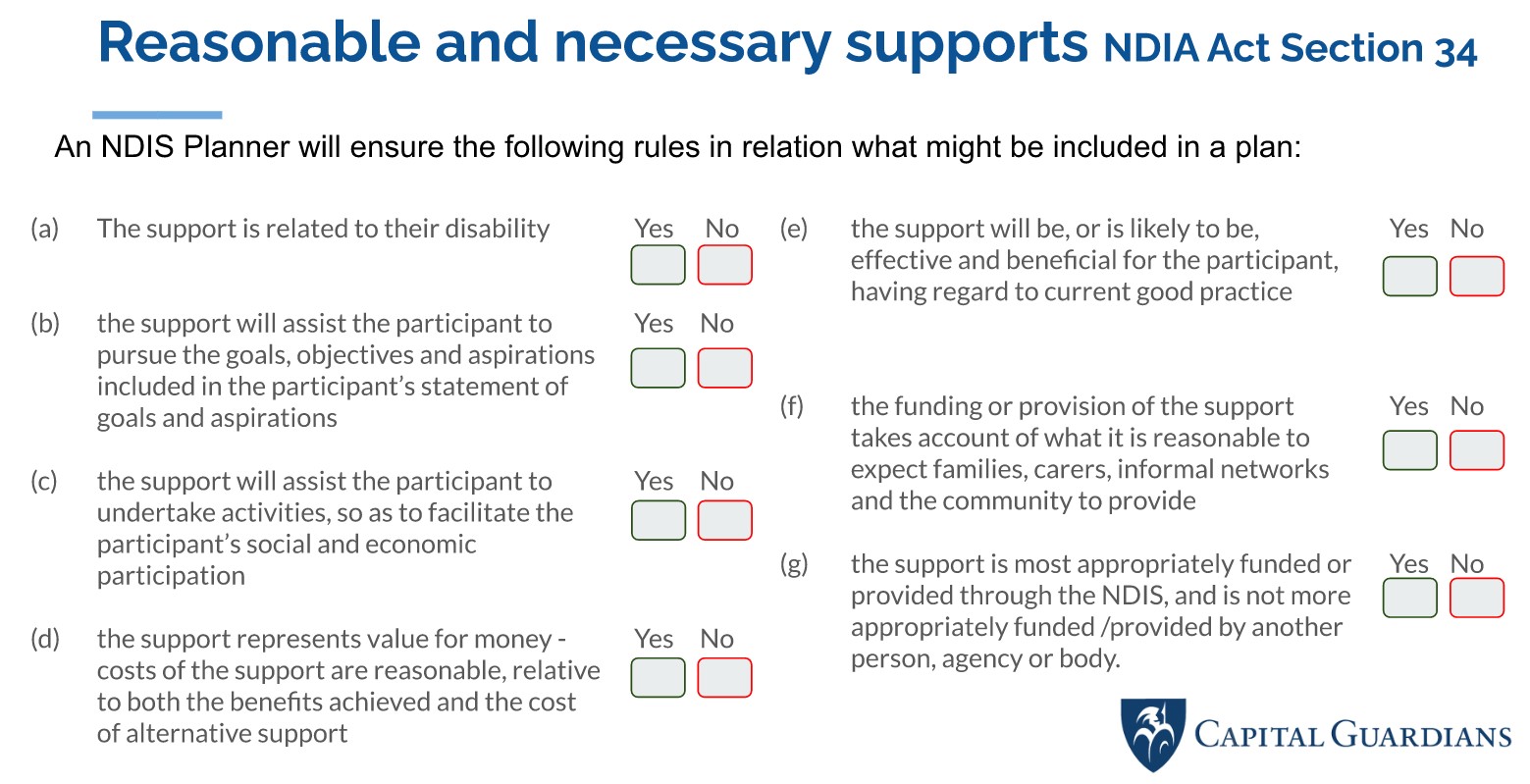

Under the NDIS, participants can receive funding for transportation through their plan. This can include funding for the participant to travel independently or with the help of a support person. If transportation is included in the participant’s NDIS plan, it can be paid for as either General Transport or Activity Based Transport using funds from their capacity-building categories.

If a provider assists with transportation, they can charge for the distance travelled and the support worker’s time. This is known as Provider Travel and is charged to the participant’s NDIS plan budget for that category.

How does general transport Funding work under the NDIS?

General transport funding is for people who need help traveling to work or appointments, like taking the bus or having a support worker drive them. If it’s included in their NDIS plan, participants can manage the funding themselves, and they receive an allowance deposited into their bank account every fortnight. It’s recommended that participants ask for self-management during planning meetings because it’s easier to manage.

How does Activity Based Transport (“ABT”) funding work in the NDIS?

Under ABT funding, NDIS participants can use the funding for activities and assistance with community participation, such as shopping. This covers the cost of transportation to and from the destination, and the person who provides the transportation also supports the participant at their destination. Providers can charge for ABT funding if it falls under the following NDIS plan categories:

- Assistance with Social and Community Participation

- Improved Living Arrangements

- Increased Social and Community Participation

- Improved Relationships

- Improved Learning

- Finding and Keeping a Job

What is Provider Travel and how does it work under the NDIS?

Provider Travel is when a provider claims for the time and expenses they incur while traveling to deliver support to a participant. There are two types of Provider Travel:

Labour costs – This refers to the time it takes the provider to travel to and from the participant’s location. It’s calculated in minutes and is pre-approved by the participant in advance based on the same hourly rate as the support provided.

NDIS states that a reasonable amount to claim for an unmodified vehicle is $0.85 per kilometre for provider transport.

Non-labour costs – This refers to costs incurred in relation to kilometers traveled, tolls, and parking when providing support to a participant. The costs are outlined in the service agreement.

What happens if a client feels that the cost of travel is more than the support provided?

The NDIA believes that participants have enough support to attend all their necessary appointments, but sometimes the costs of travel for therapy are not covered by the participant’s funding.

If you have concerns, here are some things you can do:

- Look for a new provider

- Check your service agreement to see what it says about travel costs

- Discuss options with your provider, such as scheduling appointments when they are already in your area or at a different time of day to reduce costs

- Talk to your Local Area Coordinator and request a plan review to fund the travel needed to achieve your goals.

Can Activity Based Transport be used when a participant receives Transport Funding?

Yes, you can use Activity Based Transport funding with Transport Funding, but there are important things to keep in mind.

- If you’re self-managed, you’ll receive an allowance for transport every two weeks.

- If a support worker assists you with an outing, you can claim their time at an agreed hourly rate, including travel time.

- This funding comes from the Relevant Assistance section of the CORE budget for social and community participation. e.g.

- 04_590_0125_6_1 Activity Based Transport 0125 Participation In Community, Social And Civic Activities or

- 04_591_0136_6_1 Activity Based Transport 0136 Group And Centre Based Activities

- Group rates apply if more than one person needs transport.

- It can’t be used to pay family members and is only for participants who can’t use public transport due to their disability.

Check with your Support Coordinator if you’re unsure if you can use both types of funding together.

I receive a transport allowance, can I use my other plan managed funds to pay for an Uber to and from TAFE? I don’t like buses.

If you receive a regular payment for transport, you cannot use your Core budget to pay for an Uber to and from TAFE. This payment is specifically for transport and cannot be used for other expenses like tips or petrol.

Can I use my NDIS funding for a sex worker?

Under NDIS legislation, sexual services cannot be funded. This includes any sexual conduct undertaken for payment, reward, or gratification, including services provided by a sex worker.

More information can be found on the NDIS website

Frequently asked questions about legislation | NDIS

Will the NDIS pay for air conditioning?

You can only use NDIS funds to pay for air conditioning if it’s specifically approved in your NDIS plan. A letter from an Occupational Therapist (OT) is not enough evidence. The NDIA may not approve air conditioning as a reasonable and necessary expense, and may see it as a standard living cost. You will need to provide additional evidence and reports to be considered for approval.

Can a wheelchair be funded in an NDIS plan?

To get a wheelchair funded through NDIS, the client must have AT (Assisted Technology) in their plan and get a recommendation from an Allied Health Therapist to ensure they get the right equipment. The therapist’s report must be provided to the NDIS Planner and should link the client’s goals in the plan. E.g. If the plan is for mental health and not mobility, it’s unlikely the request will be approved.

Does the NDIS cover prescription glasses?

No, prescription glasses are covered by the health system and not by the NDIS.

Glasses that might be funded must be disability specific and documented in the NDIS Plan to be covered under an NDIS plan.

Can an NDIS plan pay for a streaming service subscription, such as Disney Plus, Netflix or Spotify?

NDIS cannot fund subscription services because they are considered private entertainment expenses that are not related to a disability. These expenses should be funded from other sources such as disability pension or private funds.

Can massage be claimed under NDIS?

In certain cases, yes, massage may be covered under NDIS plans. Massage would need to be written/included in the Participant’s NDIS plan.

Will NDIS fund a vacuum cleaner?

An NDIS Plan will not fund a vacuum cleaner, but if a participant can’t perform tasks like vacuuming and cleaning because of their disability, the NDIS will provide funds for a support worker to do these tasks instead. A cleaner will have their own equipment to undertake the job.

Are swimming lessons funded under NDIS?

This depends on each individual situation and varies from person to person. Traditional swimming lessons are unlikely to be considered reasonable and necessary and an activity that all parents would be expected to pay in the costs of raising their children. The NDIS addressed this issue directly, saying that it doesn’t usually fund private swimming lessons because they don’t offer value for money and are something that anyone would take part in. Read the example below:

There are several exceptions or workarounds in regards to swimming lessons.

- Swim with your support worker – find a support worker who specializes in physical activity and swimming. This can be a great way to develop skills and confidence. Your support worker can take you to the pool and give you an informal lesson. Keep in mind though that you’ll have to pay the entrance fees from your own pocket. Swimming is also a great low-impact exercise.

- Join a social swimming group. If one of your goals is to develop your social skills this would be a great way to include swimming.

- Approved Example: In a claim recently, 6 year old Michaela had the goals to increase muscle tone, strength, balance and coordination and to continue to develop her social skills. When the invoice arrived it clearly stated the swimming was a social swimming group specifically for children with disabilities. Between the goals and the intention stated on the invoice, as well as meeting the criteria for reasonable and necessary activities, this was approved and Michaela gets to join in with her weekly social swimming group.

Will NDIS pay for a fridge or other household items?

No. A fridge is a day-to-day living cost. Just like rent, groceries, utilities, telephone or internet costs, NDIS will not fund these items. This also applies to other general household items such as a bed, washing machine and or cooking utensils.

Will NDIS fund music lessons?

Having music lessons or attending a community music group is different to music therapy. For this reason, music lessons are not funded under Therapeutic Supports by the NDIS. If an NDIS Planner did find music lessons Reasonable and Necessary, then they would list them in the NDIS Plan. As with the situation with swimming lessons, if it was a group Music Therapy (see next FAQ) session, and related to the NDIS plan to achieve social and/or coordination goals, then this kind of situation may be approved. In every case, plan mangers always refer back to the plan, to make sure it aligns with the goals of the participant.

Can I use my funds for music therapy?

Music therapy may be funded under your NDIS plan if the therapy is provided by a Registered Music Therapist (registered with the Australian Music Therapy Association) and if music therapy will help you work towards your goals.

Is insurance for my wheelchair or Scooter covered?

There is currently no clear process for insuring wheelchairs or scooters using NDIS funding. This would need to be discussed with your planner and approval given under the plan to allow this to be covered.

Can I buy a Thermomix using my funds?

A Thermomix is considered a high-risk and high-cost item (over $1500) and needs to be stated in the plan. Prior to the Thermomix being included in the client’s plan it would need to go through the NDIS approval process. For NDIS approval, this requires a comprehensive assessment (including trial) and report, which is then sent to NDIA for approval.

—– NDIA RULING ON ONE THERMOMIX REQUEST —-

Re Thermomix:

In regards to a Thermomix, unfortunately the NDIS does not fund the costs of these for the following reasons, I have also included advice from the NDIS where they stipulate they will not fund a Thermomix.

- There is a risk of injury with improper use.

- It is an everyday living expense not directly related to one’s disability.

- It does not substantially reduce the cost of future funding to justify its cost.

- There are other, cheaper alternatives available on the market that perform the same duties a Thermomix does.

- The NDIS funds the costs of individuals to be assisted by another person to teach them how to cook/make adjustments to their daily living to support this if required.

Declined funding of Thermomix as it does not meet reasonable and necessary criteria as per NDIS Act section 34.1. (d) (c) and NDIS rules 2013 5.1 (a) and (c). This support constitutes an everyday living cost, (National Disability Insurance Scheme (Supports for Participants) Rules 2013 part 5.1): The function of a Thermomix is to combine several general household appliances commonly used in meal preparation. It is acknowledged that the Thermomix and similar kitchen machines reportedly assist with the processes involved and are reported to minimise associated tasks. However, separately, the appliances would normally be purchased by any person, hence not appropriately funded by the NDIS. There are similar items on the market that can be purchased for substantially lower cost [NDIS Act 2013, Section 34.1.c].

Delegate has taken into consideration the risk involved with lifting and moving the jug of a Thermomix, whether it be full of hot food or water after the self-clean function, poses a significant risk of injuring one selves if they are unsteady on their feet and have minimal fine and gross motor skills. Additional funding for domestic supports will be required should one injure themselves while utilising the Thermomix, there is insufficient evidence available to support that utilising a Thermomix will reduce the need for domestic supports in the future. Funding is provided in Core and Capacity Building to support an individual to increase their strength and fine and gross motor function and, to support capacity in food preparation

I do acknowledge that the Thermomix website advertises they can be funded by the NDIS, however unfortunately, many businesses will market things like this and advertise products and services as NDIS fundable when they are not. The NDIS is not responsible for false claims and advertising such as this, for all relevant advice I would always suggest reaching out to your My NDIS Contact or double checking the NDIS website.

Kind Regards,

[********]

Local Area Coordinator

Can I access equine therapy?

Equine therapy (horses) may be covered under your NDIS plan, but it must be connected to your NDIS plan goals and provided by a suitability qualified allied health professional.

Therapy programs that aren’t run by qualified therapists are not covered. For example, a horse riding school running a horse therapy program without a suitably qualified allied health professional does not qualify, nor does a private horse owner providing lessons.

To obtain NDIS funding for Riding for the Disabled, the request must relate to the disability, the goals in the NDIS plan and be good value for money. In NDIS it always comes back to the goals of the plan. For example, depending on how the goals are set, the funding could come from different parts of the plan, depending on if the goal is more related to social activities, or capacity building.

Can I claim gardening, cleaning and maintenance under my child’s NDIS plan?

These activities are considered day-to-day life activities and as such cannot be paid for using children’s funding. The NDIS will only provide funding for cleaning, gardening or maintenance if it is related to the NDIS recipient’s plan, none of these activities cannot be paid for using children’s plans, it is the child’s money for their support and capacity-building.

Can I use NDIS funding to employ a tutor for my child?

The NDIS does not cover tutoring. The NDIS offers lots of opportunities to assist participants access the community, technology and other resources, but it doesn’t fund support that is already the responsibility of ‘mainstream’ services such as education.

Psychosocial Plans and funding under NDIS

Psychosocial plans are designed around mental health and as such cannot be used to fund items such as adjustable beds, scooters, home improvements or any other maintenance that is considered the homeowners responsibility.

I’ve bought a bed for my spare room, can I use my funding to pay a handyman to put it together? (Client has a husband and son who can assist to undertake this)

This is considered an everyday life expense, the bed for the spare room is not related to your disability, and is something your informal supports can assist with. This cannot be paid for via NDIS plan funds.

My daughter doesn’t like large groups or noise, can I hire out an entire salon so she can have her haircut?

This would not be considered value for money and cannot be claimed using NDIS funds. Mobile hairdressers would be the best option here to have the hairdresser attend the home. Haircuts are everyday living expenses and as such cannot be paid for using NDIS funding.

My dog is my support, can I pay for boarding costs & vet bills?

NDIS fund assistance animals, but don’t fund pets or companion animals. In most cases, animals you buy to give you companionship, fun and emotional support are seen as pets. The costs of buying, training, feeding and looking after a pet or companion animal is a day to day living cost that is not related to your disability needs. Families and individuals are expected to pay and care for a pet or companion animal, the same as for anyone without a disability.

Can I purchase a weighted blanket?

Please refer to the NDIS Participant Fact Sheet for Basic Assistive Technology which states: “Excludes weighted blankets, bed-sticks, poles, bedrails and bed rail covers as these are considered more complex (Level 3 or Level 4) Assistive Technology.

Can I use my child’s NDIS funding for an Autism Spectrum Disorder Assessment?

An Autism Spectrum Disorder Assessment is a diagnostic assessment, and you cannot use your NDIS funding for this. The NDIS is not designed to fund supports more appropriately funded or provided by the health system. In Australia, assessment, diagnosis and treatment of health conditions, along with medications and hospital care, remain the responsibility of the health system. Medicare rebates are available for children under 13 years of age (autism assessments only). A referral letter from a Pediatrician or Child Psychologist is essential if you want to claim a Medicare rebate for the assessment.

Is a functional assessment covered under my NDIS Plan?

NDIS funding can be used for functional assessments which are used to assess a person’s abilities, disabilities, strengths, challenges, improvements or decline in functioning; and areas that require support. Functional assessments are generally carried out through an Allied Health professional (Occupational Therapist, Physiotherapist).

Can I purchase a bean bag or sensory chair?

There isn’t enough research or evidence that supports this type of sensory equipment is effective. In fact, some research shows that this sensory equipment isn’t likely to help improve functional capacity. This means these supports are not likely to be ‘reasonable and necessary’.

Other things to take into account

- many sensory supports such as balls, fidgets, bean bags, trampolines and swing sets are difficult to separate from everyday household items. This means they are things that most people are likely to have in their home. They could be seen as day-to-day living costs, which can’t be funded by NDIS

- sensory supports such as swings, trampolines and splash pools are often available and accessible in the community or through community providers. As they’re publicly available for a low cost, the benefits of these supports are generally not enough to justify funding them. So they’re not considered value for money under NDIS criteria.

Can I purchase an iPad / Tablet / smart phone / computer-based assistive technology with my NDIS funds? What evidence do I need?

NDIS won’t usually include funding in your plan for you to buy or rent a tablet or a computer to run computer based assistive technology. This is because these items are a day-to-day living cost.

For the NDIS to decide to include an item such as this in your plan, you need to provide evidence that shows you need the device because of your disability. You’ll need to provide this evidence no matter what the device costs. The evidence needs to be in writing from an assistive technology advisor. It needs to confirm the device is the most appropriate solution for your disability support needs, if it meets the NDIS funding criteria this can be included in your plan.

If you want to use funds already in your plan to buy a tablet or computer based assistive technology you’ll need to get written advice from an assistive technology advisor. The advice needs to show you need the device because of your disability.

- More information can be found on the NDIS website

Assistive technology operational guideline

Is parent/carer training funded under my child’s NDIS plan?

You can receive funding to improve your ability to support your child achieve their goals but the training must be either specifically written in your plan or support a plan goal and be specific to training.

For example a plan goal may be

- To increase my knowledge about my child or young person’s disability

- To understand their behaviour and needs to support them better

It is a good idea to mention your need for training during your planning meeting so this can be specifically included in the plan.

Can I use my funding to pay for music/dance/art/yoga classes?

NDIS does not typically pay for the cost of activities, unless a specific activity is identified in the plan.

Your funding can be used be used to assist you with getting to and from an event or music / dance/ art / yoga class for example, or pay for a support worker to assist you to attend events or classes if there are disability related barriers to taking part, but not the actual cost of the activity itself. If the lesson / class is not disability specific it is considered an everyday living cost anyone with or without a disability, choosing that social activity, would have to pay.

If the lesson/class is disability specific, delivered by a Licensed Therapist and is an activity designed to build skills and independence and you have CB Social, Increased Social and Community Participation funding in your plan, then yes it can be claimed. All supports funded under this item need to be deemed reasonable and necessary and align with the goals as per your NDIS plan.

An example would be:

- Private music lesson – day to day expense

- Private music lesson delivered by a Licensed Music therapist – claimable

See below link for further details

https://ourguidelines.ndis.gov.au/media/1532/download

Are gym memberships funded under my plan?

The NDIA do not fund supports that are day-to-day living costs for people whether or not they have a disability. If one of your goals is to get fit by going to a gym or playing sport, they may fund a support or assistive technology to help you to do these activities, but not the gym membership itself.

https://ourguidelines.ndis.gov.au/would-we-fund-it/improved-health-and-wellbeing/gym-membership

Can I have meals delivered/prepared under my NDIS funding?

Effective 1 March 2022, NDIS updated their guidelines to allow NDIS participants who usually have a support worker to help them prepare meals at home or help with grocery shopping, to allow them to flexibly use these funds to pay for delivered and prepared meals in certain circumstances.

A new support item has been added to the pricing arrangements 01_023_0120_1_1: Assistance with the cost of preparation and delivery of meals. Providers will no longer need to submit quotes for meal preparation and delivery supports included in new plans from 1 March 2022, however this support must be specifically included in the plan for a provider to be able to claim.

If you are unsure if this has been included in your plan, please contact your Local Area Coordinator/planner for clarification.

Can a support worker’s theatre ticket be paid for with NDIS funding?

According to the NDIS Pricing Arrangements and Price Limits 2022-23 this is covered by guidance relating to ‘Expenses Related to Recreational Pursuits’, which states providers should not claim payment from participants’ plans for:

- Expenses related to recreational pursuits, such as event tickets for the participant, or

- The cost of entry for a paid support worker to attend a social or recreational event.

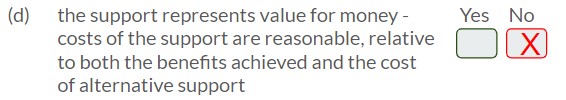

Can I buy a mattress with my low cost AT funding?

NDIS funding may be approved for a pressure or hygiene mattress if it is deemed necessary due to the individual’s disability. However, evidence or information is needed to demonstrate that the mattress:

- directly addresses the participant’s disability,

- represents value for money compared to alternatives, and

- will be effective and beneficial for the participant.

It‘s important to note that simply buying a new mattress does not mean that it will be funded. The mattress must specifically address the client’s disability-related needs, and be different from a standard mattress that fulfills an everyday need. Please refer to this link for more information

https://ourguidelines.ndis.gov.au/would-we-fund-it/assistive-technologies/non-standard-mattresses

Can I use my core funding for builder’s quotes?

NDIS quotes are expected to be provided at no cost as general quotes are not typically funded by the scheme.

Consultation, design, drawings, and related services fall within the scope of the capital home modifications budget.

Occupational therapists (OT) would be responsible for defining the scope of works for simple cases. In complex cases that need approval from an architect or structural engineer, funds would be sought or allocated within the plan to enable the architect or builder to meet their obligations, as outlined in the Capital Home Modifications (CHM) form.

Can I purchase gym / therapy equipment my PT / OT has recommended?

Exercise equipment is considered a daily living expense and would not meet the reasonable and necessary criteria.

Supports not only needs to align with a participant’s goals and be considered reasonable and necessary. It also has to represent value for money, be most appropriately funded through the NDIS and meet other NDIS criteria.

For example, if the plan already has support for exercise physiology therapy, it is expected that the Exercise Physiologist would provide appropriate equipment for this therapy and suggest solutions that can be used in the home, such as resistance bands.

Can I use my funding for self paced therapy kits?

Self-paced therapy kits for at-home use cannot be purchased using CB Daily Activity funding. Therapy support eligible under CB Daily Activity must be provided either in-person or through telehealth services.

However, if participants have consumables funding allocated in their plan, they may potentially use these funds to acquire therapy self-paced kits, provided they align with the reasonable and necessary criteria and with the participant’s goals, as outlined in their plan.

Do I need to take out insurance to insure carers??

No. Carers are Independent contractors you do not engage them as employees. If someone is an employee, you are required to cover their superannuation, taxes, workcover, and similar obligations.

Contractors have their own Australian Business Number (ABN) and are solely accountable for their own insurance.

Nevertheless, it is advisable to verify that your home insurance provides coverage for potential public liability situations involving your workers or anyone visiting your residence. This should be regarded as a personal expense and not claimable under NDIS, something any home occupier should have.

Is equine therapy covered under my NDIS plan?

Activities that involve positive experiences with animals, like playing with puppies or riding horses, are sometimes called ‘animal therapy’ by service providers.

Recreational, social, or sporting activities with animals might also be labelled as animal therapy.

However, these activities are not the same as animal-assisted therapeutic interventions and are not considered NDIS supports, even if offered by an allied health professional.

More information can be found on the NDIS website:

Frequently asked questions about legislation | NDIS

Can a support worker help me to engage in recreational horse riding?

Yes. A support worker can be funded to assist you undertake this activity. However, you will still need to pay for the costs involved of the activity, these are costs that everyone must pay for these kinds of activities whether or not they have a disability.

More information can be found on the NDIS website:

Frequently asked questions about legislation | NDIS

If my activity is with a disability specific group or centre is it funded?

A support worker can be funded to help engage in the activity when it is happening but participants will still need to pay for the general costs of the sporting, social or recreational activity as these are costs everyone must pay for when taking part in these kinds of activities.

More information can be found on the NDIS website:

Frequently asked questions about legislation | NDIS

I have an assistance animal, can I claim pet insurance?

NDIS funding can be used to purchase an assistance animal and pay for most of its associated costs when approved, but funding cannot be used to pay for pet insurance for an assistance animal.

More information can be found on the NDIS website:

Our Guideline – Assistance animals

Frequently asked questions about legislation | NDIS

Can I buy a pet or companion animal with my funding?

NDIS funding cannot be used to buy pets or companion animals, or to pay for any animal related costs including pet food, toys, accessories, vet costs, boarding, grooming or insurance.

Can I have driving lessons funded?

Driver training can be funded for eligible participants. Driving lessons can’t be funded without submitting evidence to the NDIA for approval. To include this in your plan, you’ll need to provide an assessment or recommendation from an allied health provider that explains why this support is needed. Keep in mind that learning to drive usually involves costs, whether you have a disability or not, so the NDIS may not fund driving lessons.

More information can be found on the NDIS website:

Frequently asked questions about legislation | NDIS

Our Guideline – Vehicle modifications

Is gaming therapy covered under my NDIS plan?

Gaming therapy may be covered if delivered by an allied health professional as part of evidence-based therapy. Therapists may use tools like games, to support structured, goal-directed interventions that align with NDIS goals. The therapy must meet the NDIS’s reasonable and necessary criteria and focus on improving functional outcomes.

Is yoga therapy covered under my NDIS plan?

Yoga therapy may be covered if delivered by a qualified allied health professional as part of evidence-based therapy. It must be a structured, goal-directed intervention aligned with NDIS goals and focused on improving functional outcomes. The therapy must also meet the NDIS’s reasonable and necessary criteria.

Is Lego therapy allowed?

For Lego therapy to be funded as a therapeutic support, it must be evidence-based, delivered as part of a goal-directed intervention, and provided by an allied health professional or appropriately qualified professional. Tools like Lego may be used to support therapy but are not the therapy itself.

Can I buy a disability specific bicycle with NDIS funding?

Yes, bicycles or tricycles with disability-specific features or designed for a participant’s needs can be funded if they meet the NDIS ‘reasonable and necessary’ criteria. Adaptation or modification costs may also be funded, but the participant or family must cover the cost of the standard bike or trike.

Standard, non-modified, bicycles or tricycles including electric bicycles are not NDIS supports.

Are modified fluids and thickeners NDIS supports?

Modified fluids and thickeners are considered NDIS-funded disability-related health supports. These may include:

• Low-cost assistive technology for feeding and swallowing needs.

• Modified foods, such as liquid thickener products.

• Assistance in preparing safe-to-eat foods.

• Support workers to help you eat or drink safely due to your disability.

Are dietetics/dietitians NDIS supports?

The NDIS list doesn’t name specific allied health practitioners but includes dietetics under “Therapeutic Supports.”

Dietetics is funded if it’s needed due to a participant’s disability and meets the reasonable and necessary criteria.

In the 2024–25 NDIS Pricing Arrangements (PAPL), dietetics is under “Capacity Building – Improved Health and Wellbeing” (pages 81–82). The PAPL is under review to reflect current practices.

Would food processors and aerators be considered exemptions to the supports that are not NDIS supports list?

Under the NDIS Transitional Rules 2024, food processors and items like prepared aerated drinks or soda streams are not considered NDIS supports. These are classified as day-to-day living costs.

Are household items recommended by a qualified speech pathologist or APD on the Replacement supports list?

Standard household items are listed as Replacement supports. Items like a blender, recommended by a speech pathologist or dietitian to prepare a participant’s special diet, may qualify as replacement items.

Participants can request these supports through the Replacement support application process.

How does STA work?

Short-Term Accommodation (STA) is designed to support informal carers by providing participants and their carers time apart.

Participants can use STA to stay away from home for up to 14 days at a time, with a maximum of 28 days per year. It covers self-care, community access, and short-term accommodation but excludes day-to-day living costs like food, groceries, lifestyle expenses, or travel. STA cannot fund items classified as non-NDIS supports.

Providers offering STA in group settings may include meals and activities in the daily rate, per NDIS Pricing Arrangements, but this does not apply to individual STA arrangements.

More details, including guidance on using hotels or other accommodation, will be available in a new operational guideline in early 2025.

Is STA available for participants in Supported Independent Living or living alone?

No. This is because if a participant is living alone or in a supported independent living arrangement, they already have time apart from family and informal supports.

Can STA be used for holidays?

Short-Term Accommodation (STA) is not for holidays or tourist travel; it provides time apart for participants and their informal supports.

STA cannot fund non-NDIS supports, including:

• Cruises, holiday packages, airfares, passports, visas, or travel insurance.

• Accommodation or travel for family members or support workers.

• Theme parks, entertainment, or conferences.

• Day-to-day living costs like food or meals, unless included in STA group settings.

Participants must negotiate costs with providers and cannot request additional funding once their budget is used. Rates are in the NDIS Pricing Arrangements and Price Limits.

For support while on holiday, participants can use their usual non-STA supports and should contact their support coordinator to arrange services in other locations.

Does STA cover the cost of transport?

STA funding cannot be used for transport to the accommodation.

If a participant chooses STA far from home, travel costs are considered day-to-day living expenses and must be paid separately. Participants should factor this into their decision when selecting an STA option.

Some participants may have transport funding in their NDIS plan. If transport is needed due to a participant’s disability, STA providers may include transport costs from the accommodation to activities they deliver.

How is STA funded?

STA is funded through a participant’s core budget if it supports their disability needs and meets reasonable and necessary criteria. It does not need to be stated in the plan.

STA is available under “assistance with daily life tasks in a group or shared living arrangement” in the NDIS supports list.

The NDIS funds standard STA rates, typically for group support, unless individual support is required. STA cannot cover non-NDIS supports.

Does the NDIS fund groceries or fast food?

No, the NDIS does not fund groceries, fast food, or takeaway, as these are considered everyday living costs. Funding for meal preparation supports depends on your plan and NDIS criteria.

Does the NDIS fund dietary supplements?

The NDIS generally does not fund dietary supplements unless they are prescribed or recommended to manage a disability-related need. In such cases, they may be considered if they meet the NDIS funding criteria.

What are dysphagia supports?

If a participant has dysphagia that is ongoing and directly related to their disability, the NDIS may fund supports such as assistive technology, modified foods, meal preparation assistance, and support workers to help with safe eating and drinking. Evidence, such as a speech pathologist’s assessment, is required to access this funding.

What can be funded if a client has dysphagia?

The NDIS may fund a speech pathologist to create a mealtime management plan and train support workers, family, or carers in disability-related dysphagia support. However, aerated drinks or household items like a soda stream are considered day-to-day living costs and are not funded.

Can the NDIS fund meal preparation or delivery services?

The NDIS may fund meal preparation and delivery but not the cost of food or ingredients. Invoices must itemize these costs separately, which services like Uber Eats and fast-food platforms typically do not provide. For more details, refer to Our Guideline – Nutrition Supports, including meal preparation.

What if my support worker is unavailable to help with meal prep or I live in a rural area?

If your plan includes funding for a support worker to assist with meal preparation, you can temporarily use this funding for meal delivery if the worker is unavailable. This should be a short-term solution, and extended use may require evidence. In rural areas, meal delivery providers must issue itemized invoices to meet NDIS requirements.

What are flexible and stated supports?

NDIS support categories are classified as either flexible or stated, based on NDIS laws. Core supports can be used flexibly within the same fund management type, while stated supports must be used exactly as described in your plan. If you’re unsure about your stated supports, speak with your My NDIS contact, support coordinator, or recovery coach. For more details, refer to the Factsheet: Support Categories and Our Guideline – Your Plan.

How are decisions about meal preparation supports made, and what evidence is needed?

Funding for meal preparation supports depends on your individual plan and NDIS criteria. If included, it may be stated or non-stated support. Providers must issue itemised invoices for meal preparation and delivery. While quotes are not usually required, additional funding or long-term arrangements may need supporting evidence, such as a recommendation or plan change request.

Are household items recommended by a qualified speech pathologist or APD on the Replacement supports list?

Standard household items on the Replacement Support List, like a blender for a special diet recommended by a speech pathologist or dietitian, may be considered replacement items. Participants who need these supports in their plan must apply through the Replacement Support application process.

Are parenting programs funded by the NDIS?

The NDIS funds reasonable and necessary supports to help children with disabilities or developmental delays achieve their goals. However, it only funds supports classified as NDIS supports and does not cover general parenting programs, which are available to all parents. This aligns with existing guidance and was clarified in the new rules introduced on 3 October 2024.

What early intervention or developmental delay supports are available to children and their parents?

Early intervention supports help children with disabilities or developmental delays, along with their families and carers, work towards specific NDIS plan goals. These programs focus on building family capacity to support a child’s independence and development, including group or one-on-one sessions. Parents with disabilities can also receive support through their NDIS plan to assist in their parenting role. The Early Childhood Approach and Early Connections guidelines provide further details, with updates ongoing as legislative changes are implemented.