What should I do if I want to dispute Cab Charge Trip?

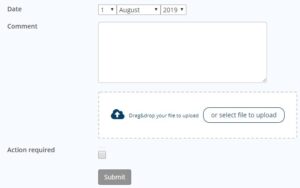

Please fill out this form dispute a Cabcharge Invoice.

Cabcharge Trip disputes must be initiated within 30 days of the trip. After this period, disputes cannot be raised.

The delete invoice function on Capital Guardians cannot be used, as Cabcharge run the account on their own software and it must be reversed with a credit through their dispute process to effectively delete an invoice.

Without the formal dispute process being followed, all trips will still be paid by the account as agreed with the indemnify for procuring the Cabcharge Service within Capital Guardians.

Once the form is submitted, the Capital Guardians team will directly dispute the trip with Cabcharge. Cabcharge will investigate and notify us of the case resolution.

Please note that we cannot guarantee refunds for all disputed trip queries. If Cabcharge resolves the query and issues a credit or refund, Capital Guardians will credit the resident’s account accordingly.

What happens on departure?

For account holders on a Home Care Package, under the Aged Care Act, any unspent funds are transferred or will be split between the government and the account holder in proportion to how they were contributed.

- Homecare funds are transferred with a move to permanent residential care, death or to move to a new provider on a mutually agreed date

- The unspent home care monies, being the total amount of home care subsidy (including any supplements) and home care fees paid (for the period of care) to an approved provider for a client, that have not been spent or committed for the client’s care will need to be:

- Transferred to the client’s new home care provider; or

- if the client has left home care (for example if they entered permanent residential aged care or passed away), returned to the Commonwealth and the client (or their estate)

Once a care recipient and provider have mutually agreed on a date to change providers, care services continue until the date for when they will become the responsibility of the new provider.

The Care Manager process is as follows

Capital Guardians needs to be notified by a logged-in Care Manager selecting the client name on the “Contact” menu item:

- Subject: “Package finish” or “Passed away”

- Comment: Ensure the date of package finish and if they left the program (transferred elsewhere, etc)

- Submit

- Vendors given 5 days for final invoices

- Any direct debits to be stopped immediately and money to be returned to the appropriate accounts (ie prepaid client fees refunded)

- A record of the “contact” notes is recorded in the client record … supporting compliance audits

As soon as reconciliations complete and contribution calculations done, Capital Guardians need to be notified by a logged-in Care Manager selecting the client name on the “Contact” menu item:

-

- Finalise account, as soon reconciliations complete and contribution calculations done, select “Contact”, enter client name: subject “Funds Return”

- Comment: Instructions on return of funds to:

- “Unallocated Deposits” + Client refund $ value; or

- 100% to another Approved provider (deposit details).

- Attach Unspent homecare monies calculator

- Capital Guardians process refunds within two days, having externally confirmed external bank account instructions.

- Comment: Instructions on return of funds to:

- Finalise account, as soon reconciliations complete and contribution calculations done, select “Contact”, enter client name: subject “Funds Return”

Is there a complaint procedure if I am unhappy with the service?

Yes, follow this link, send us an email or call in the first instance, you may be asked to clarify your issues, provide more information, and discuss your expectations. Please provide as much information as you can when you lodge your complaint. This helps us to understand all the issues and determine the most appropriate way to resolve your concern.

Our Complaints Policy is attached, for insight on how we deal with complaints internally.

How do I control spending in Capital Guardians?

Capital Guardians has a significant number of controls for customers to control expenditure, including:

- Selecting the service providers who have access to invoice the resident (including taking service providers off)

- Total limits per supplier. A customer can limit the total billings any supplier can make in a week by selecting the total supplier limit. Note, facilities are also service providers and limits can be made here on the amount of cash given out at facilities.

- Daily limits per supplier. This restricts the total billing value (on a day)

- Using the budget and booking tool available organisations or self-managed account holders and/or their representatives. The booking tool allows users to allocate a budget to several service providers and ensuring requests for goods and services are kept within budget, and the supplier has written confirmation of what can be invoiced.

Please note, the system controls above are really a backup. The most appropriate control comprises individual discussions with service providers and/or carers (i.e. care organisation) on appropriate spending, affordability, and limits. It is very important for service providers to understand restrictions independently of the Capital Guardians system not allowing an invoice to be created. When an invoice cannot be created, it does not mean a debt is not owing.

These controls appear in your login; alternatively, you can contact Capital Guardians for advice.

Payment of providers

All approved providers invoices for home care packages are paid every Friday. There are no payment terms.

Ideally, care managers review all invoices to be approved every Thursday, and approve, or otherwise contact the provider, allowing providers to be paid quickly.

How is GST treated?

For government-funded home care within the Home Care Packages Program, GST cannot be put on a home care package, and where payable, must be paid to the supplier and subsequently claimed on the Approved Provider BAS reimburse the Approved Providers BAS payment.

Capital guardians facilitate this by setting up a GST account, that will collect any GST identified on any invoices, keeping off client statements and enabling the Approved Provider to collect and eft the monies back to pay back this GST “overdraft” account.

- All the invoices of an Approved Provider are GST free except exit fees. Approved providers are required to remit GST on all exit fee income to the ATO

- Invoices from third-party organisations to clients of Approved Providers (Sub-contracted services) GST is payable unless the services are GST free, see Non-government funded home care services below

- Approved Providers will claim GST expenditure, as recorded in Capital Guardians on their BAS statement, and refund an established GST Account in Capital Guardians, thereby avoiding any GST on client home care statements.

Details can be found:

- The supply of home care services by the service provider will be GST-free under section 38-30(3) of A New Tax System (Goods and Services Tax) Act 1999 (GST Act)

- A supply of home care is GST‑free if home care subsidy is payable under Part 3‑2 of the Aged Care Act 1997 to the supplier for the care

- Eligible services Item 2.1 of Part 2 of Schedule 1, Quality of Care Principles 2014. Part 3.2: Quality of Care Principles 2014, Schedule 3 “Care and services for home care services.”

Generally, the supply of any of the following home care services are GST-free:

- personal assistance, including individual attention, individual supervision, and physical assistance with bathing, showering, personal hygiene, and grooming

- maintaining continence or managing incontinence, and using aids and appliances designed to assist continence management

- eating and eating aids, and using eating utensils and eating aids (including actual feeding if necessary)

- dressing, undressing and using dressing aids

- moving, walking, wheelchair use, and using devices and appliances designed to aid mobility, including the fitting of artificial limbs and other personal mobility aid

- communication, including addressing difficulties arising from impaired hearing, sight or speech, or lack of common language (including fitting sensory communication aids), and checking hearing aid batteries and cleaning spectacles.

Examples of home care services that are not GST-free:

- hairdressing

- housework and gardening

- preparing meals and grocery shopping for individuals

- aids, appliances and monitoring medication; however, they may be GST-free health supplies under a different section of the GST Act

- rehabilitation and health care services; however, they may be GST-free health supplies under a different section of the GST Act

- help with writing cheques, emails, and letters

- advocacy services

- accommodation

- driving individuals to and from appointments and social activities

- social and community activities, such as providing companionship, craft, and reading activities to individuals.

Please note, where an individual voluntarily contributes money to their care for services by a home care provider, many services, care will need GST to be paid, such as:

- Monitoring and applying medication

- Provision of social and community activities, such as companionship or security for clients feeling lonely or vulnerable, or initiating and taking part in craft or reading and more

- Provision of rehabilitation services

- Home help such as domestic chores, gardening or home maintenance, including making beds and general tidying of living quarters;

- Meal preparation

- Provision of travel services and transport assistance

- Grocery shopping.

Questioning a service provider’s invoice?

Capital Guardians does not check the validity of services or products on service providers’ invoices, as this is the responsibility of the invoice approver, typically the Care Manager.

If an account holder or Care Manager has a query in relation to a service providers charge, then they should liaise directly with the service provider in relation to the charge. If it is agreed that a credit is required, then the supplier will credit the account on the next invoice or statement.

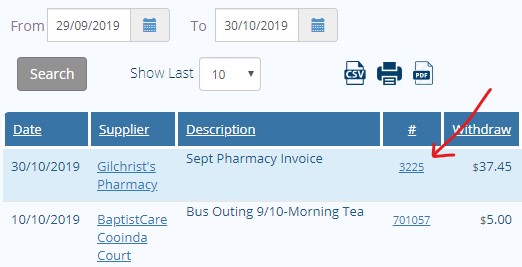

By selecting the Transaction ID on the invoicing in a client’s statement, all unapproved invoices can be deleted with a message to the service provider. Again, it is recommended a verbal conversation is taken with the service provider to support a positive relationship.

Contractually, with Capital Guardians, all service providers must keep a “proof of delivery of good or service” record and present it on request. If there is disagreement regarding a charge and the proof of delivery cannot be presented, then Capital Guardians will reverse the charge. This process is very similar to how credit card company “chargebacks” work.

Claiming and allocations of Government Subsidies

Approved providers of home care, claim funding via a Department of Human Services login, whereby individual care recipients are details are recorded, and funding is requested.

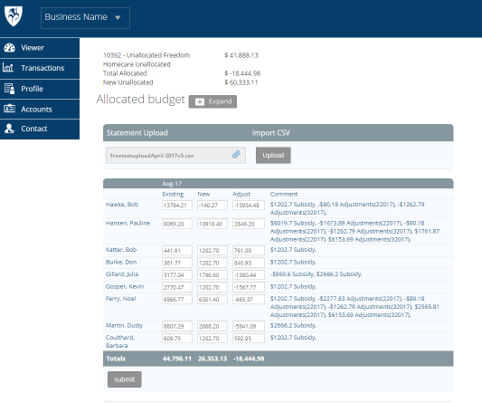

Funding is generally deposited in lump sums within the first five working days of each calendar month as an estimate of the months funding. This is based on the prior months funding. Several days later into the month, the Department of Human Services makes an actual statement available in pdf and CSV (i.e. Excel) format of the prior months actual funding, that considers the earlier estimates and makes up for shortfalls or overpayments.

Capital Guardians has the ability to allocate money according to your estimate/budget, in absence of a remittance from Department of Human Services. This allows an upload of the actual remittance, with the system making any adjustments necessary to ensure the month’s subsidy is equal to the remittance for that month.

Provider users who have an Admin button on their login, give the ability to select the Allocation button, select the relevant month, and allow the system to allocate money shown as unallocated to the relevant months budget. This can be useful to get money quickly into an account to pay invoices, prior to getting a formal remittance from the Department of Human Services.

When the formal remittance is available, the Administration user from the provider will upload the CSV file which has been downloaded from the Department of Human Services portal, and all the funding monies will be allocated, and adjusted for any estimates made earlier in the month.

Process:

- Ensure all account have their Dept Human Services ID number entered (nine digits), access from the Viewer menu.

- Support office login and select “Admin”

- Import “csv” from Dept of Human Services login .. Upload

- All accounts are matched from their Medicare ID.

- “Existing”, any estimate within the month

- “New”, comprising allocations per the Medicare remittance (including prior period adjustments)

- “Adjust”, the difference between what was allocated and what should be allocated.

- Submit will allocate the “Adjust” amount accordingly to the relevant accounts, taking money from “Unallocated”

How do Capital Guardians get paid?

Capital Guardians sole purpose is to keep costs down and make things simple, subsequently:

- Capital Guardians pays invoices immediately from its own money, and gets reimbursed the following month or later from the Government paying monthly financial claims by the Approved Provider for Home Care. This can be upto 40 days after the payment is made.

- The service is designed to keep the price down (i.e. $3 per month) to the very minimum and subsequently operates mostly automatically with little manual intervention. Capital guardians have fully automated where possible for adding new users; paying service providers and record deposits.

- To pay service providers quickly, and making invoicing simple, there is a 2% merchant fee on home care invoices (cheaper than PayPal and Amex and depending on provider, comparable with Visa and Mastercard).

- Software development was briefed to build a system that was capable of millions of transactions per year and at least 500,000 customers. The application has been developed in php (common programming code), with an infinitely scalable SQL server database and sits on the world’s largest hosting provider, Amazon, in their Australian hosting facility.

- The work-intensive part of capital guardians is mobilising the service into new communities. This comprises solely of training, answering queries, and change management. There are no project or consulting costs, typical of information technology projects.

There are no contracts. If our service is no longer required, please let Capital Guardians know, in writing (i.e. email) and include the bank account details for the return of monies.

Collecting Home Care Client Fees?

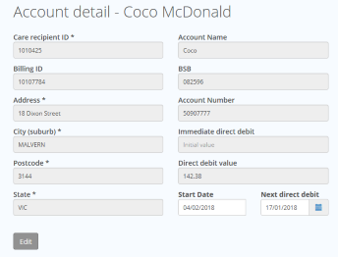

Capital Guardians allow Care Managers to set up a fortnightly recurring direct debit that covers any means-tested fee or discretionary client care fee determined payable. Once setup this will collect outstanding and future payments owing from the client.

A direct debit is an authority a customer signs with an organisation, approved under banking rules, to take money directly from a nominated account under a set of specified conditions.

Alternatives to direct debit, including the client paying directly into the Capital Guardians trust account; however, Capital Guardians do not monitor these payments or invoice for these payments.

Process:

- By selecting the check edit icon next to an account’s name, direct debits can:

- have their fortnightly value change

- have an upfront initial amount taken immediately

- turn the direct debit off

- charge an immediate, once off direct debit

- Bank account numbers can only be entered once, cannot be changed without Capital Guardians

Ordering Cabcharge Cards

Cabcharge cards are issued in client names and can be used in any taxi anywhere in Australia. All trip times and locations will be shown in the Capital Guardians statement weekly.

A $10 issuance fee applies to each new PHYSICAL Cabcharge Card to cover printing and shipping costs. There is $0 cost for a Digital Fast Card (mobile phone required for activation and usage). To learn more about the Digital Fast Card option, click here: iPhone users (IOS) or Other users (Android).

In ordering a Cabcharge Card, the user and their representative agree to be financially responsible for all taxi trips taken on the card, and indemnify Capital Guardian for any costs it may incur regarding the use of the card.

Trip limits can be built into the card and email notifications and maps sent for every trip.

To order a Cabcharge card please complete the following Cab charge request Order Form.

Cabcharge Cancellation

Cards must be canceled immediately upon receiving the client’s departure notification. Please complete the cancellation form by Click here.

Security of invoicing?

There is significant protection around invoices on to accounts as follows:

- Service Provider Trust. Whereby care recipients do have a say in their care providers, the home care provider has a legal obligation to ensure the providers: comply with the expected standards; offer value for money; are of good character (including recent police checks for anybody visiting a home); and have the capability to provide the full service deemed necessary by the Home Care Provider. Subsequently, the Home Care Provider will have the first and final say in service providers.

- As such, any service providers whose integrity may be questioned, will not last (that is if they get an opportunity to service an account in the first place). There is a lot at stake for someone doing the wrong thing.

- “Transparency.” Capital Guardians is about transparency, as soon as an invoice has been submitted, then it is visible to all parties, including the care recipient and their representatives. The Capital Guardians system allows any variance to the budget to be investigated, online immediately by “drilling down” into the expense, right down to the detailed “pdf” (an electronic version of the invoice, that can be printed), online.

- Proof of service or goods delivery. As a requirement, all service providers must be able to keep a record that proves that the goods or service was delivered. As contracted and agreed with the supplier, if there is ever a dispute over an invoice, then they need to provide this evidence or risk the payment not being made or reversed. As a requirement of the Capital Guardians supplier payment agreement, the Capital Guardians audit also randomly sample service provider’s compliance with keeping such evidence.

- Finally, Home Care Provider “review” and authorisation of invoices. As part of the monthly process, home care providers approved all submitted invoices for payment. Their approval will only come after they review the budgeted amounts, their care plan, and general knowledge of the services provided.

More information is available on Security at www.capitalguardians.com

When providers do not invoice

- If service providers (ie care providers, cleaners, nurses, etc) do not invoice promptly, then accounts can appear overstated, with account balances higher than they should be. This would be most obvious when reviewing the budget variance report, where it might be noticed that planned expenditures are missing, where there is the knowledge that those services were performed.

- Experience has shown that Local Government (ie councils), cannot be relied upon for invoicing. When services are sought from these organisations, it is best they are monitored.

- Typically, providers of care like to get paid therefore, invoice promptly, and all have signed Capital Guardians terms requesting invoices, at the latest, 5 days from month end.

- Discipline is by all required parties in process and procedure (what we know as the Quality Management System). One area that is always watched carefully is the timeliness of service providers invoicing accounts.

- Capital Guardians recognises an invoice against the account as soon as it has been submitted online by a service provider. Submitting invoices is “easy” and Capital Guardians can talk to any accounting system and have invoices entered in under a minute, with one thumb on a smartphone by smaller service providers with agreed fixed prices.

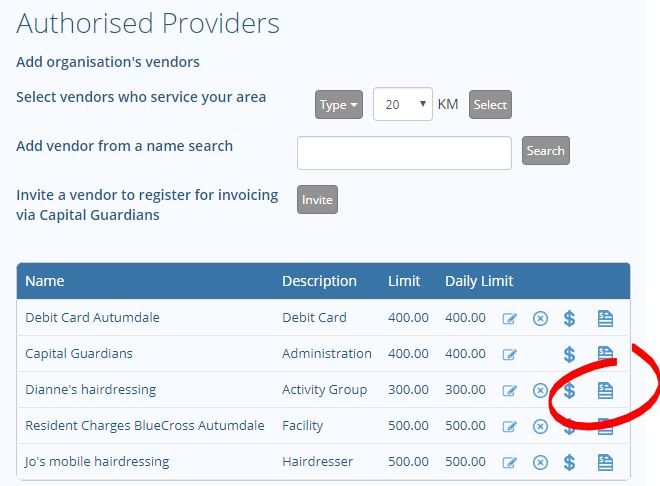

How do providers see clients to invoice?

If a provider registers on our home page, and identifies you as the Approved Provider, they will appear in your short list of Providers on your providers tab. Having registered, the provider will not be able to invoice until they are linked to an account.

If there is a green dot on your dashboard, then they are linked.

To link a provider, select the client’s name and add from your organisations vendors or searching the registered provider name. As soon as link, a green dot will appear on the Viewer page and invoicing will work.

Can I put an invoice in for a client on behalf of a supplier?

The supplier must be registered with Capital Guardians, then care managers can put an invoice in on behalf of the supplier.

- After registration, the care manager will select the “Viewer” menu option and then select the underlined client name.

- Under “Authorised Providers”, identify the supplier, then select the invoice icon.

- In the single invoice fill out the description, the amount and upload file (invoice) by selecting browse to the location on the computer where the invoice has been saved

- Select the “Send Invoice” button to submit the invoice.

Deleting an invoice

To delete an invoice, log into Capital Guardians website. Click on “Transactions” in the main menu. Select the underlined invoice number of the invoice which needs to be deleted in the “Recent Transactions” table.

Please note, invoices which are “Paid” status cannot be deleted.

When in the transaction detail area, type in a reason why the invoice needs to be deleted in “message to the service provider about the invoice:” dialog box. Select the “send & delete” button. Deleting of invoice successfully completed.

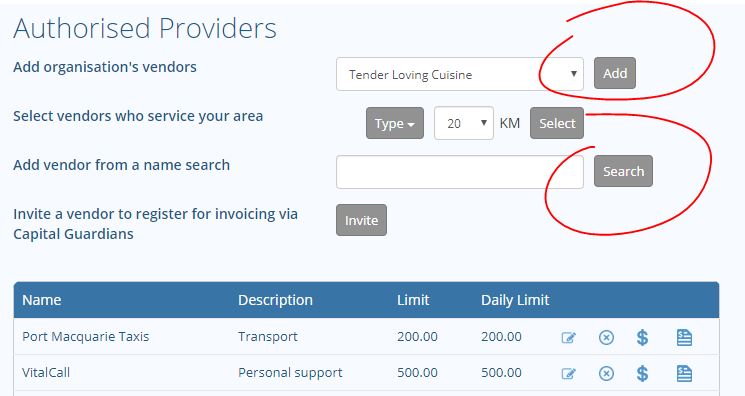

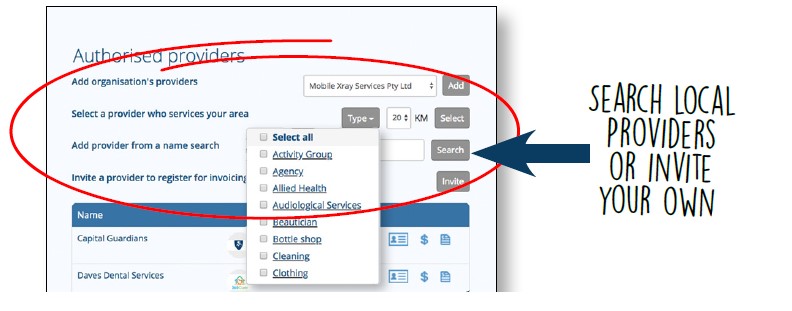

How do I enter new providers/suppliers?

New providers of goods and services are invited to register (not entered, they enter themselves).

Select the Providers tab, or a client name. This allows a search of local providers within Capital Guardians.

Alternately, just invite a provider to register with their email address by selecting Invite.

Providers not invited can register at www.capitalguardians.com, select Register top right and by selecting Provider Registration. Here they select the Approved Home Care Packages Provider (community) or enter the client name. They will appear on your shortlist, however, cannot invoice or see clients name until an approved provider adds them to an account.

It only takes minutes for a Provider to register. The registration process will automatically confirm their AB. In addition, providers can upload their Police Check, Insurance and other forms, and can be seen in search and user logins.