Reasonable and necessary supports (NDIA Act Section 34)

Reasonable and necessary is a term used to determine what kind of funded supports you might need. Simply put – reasonable is something that is considered fair, and necessary is something that you need because of your disability and to help you bridge the gap between your disability and achieving your goals.

In order to be considered reasonable and necessary, a support or service: must be related to a participant’s disability, should represent value for money, must not include day-to-day living costs not related to your disability support needs, such as groceries.

The NDIS cannot fund a support that is: the responsibility of another government system or community service. not related to a person’s disability

An NDIS Planner will ensure the following rules in relation what might be included in a plan.

- The support is related to their disability

- The support will assist the participant to pursue the goals, objectives and aspirations included in the participant’s statement of goals and aspirations

- The support will assist the participant to undertake activities, so as to facilitate the participant’s social and economic participation

- The support represents value for money – costs of the support are reasonable, relative to both the benefits achieved and the cost of alternative support

- The support will be, or is likely to be, effective and beneficial for the participant, having regard to current good practice

- The funding or provision of the support takes account of what it is reasonable to expect families, carers, informal networks and the community to provide

- The support is most appropriately funded or provided through the NDIS, and is not more appropriately funded /provided by another person, agency or body.

Specific examples of regular questions, or grey areas we get asked are as follows FAQ Reasonable and Necessary

How do I manage my plan’s spending to last the whole plan period?

Capital Guardian’s unique real-time NDIS Statements and NDIS Plan Monitor allow monitoring by participants anytime anywhere. The spending monitor in green counts the time elapsed over the plan and compares to the spending to this date. If spending exceed the remaining time, the monitor will turn red, alerting that spending will run out if it continues at the current rate. Selecting the “+” on an or the categories of Core, Capital, and Capacity Building will display monitors of the different budgets for the NDIS Plan.

Why choose Capital Guardians?

- We answer the phone! (local phone no 1800 numbers or call waiting).

- We have local representatives who live near you and know you personally.

- Invoices of providers of services are paid overnight. Participants (or their representatives) obtain invoice approval immediately via mobile notifications.

- Offer a real-time spending monitor, linked in real-time to their NDIS Plan for clients and Support Coordinators.

- Capital Guardians pays approved invoices from providers quickly using an automated process, using direct software links to major accounting applications (Xero, Myob & Quickbooks), OCR scanning of pdf invoices sent direct, and its mobile invoice applications.

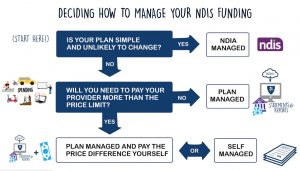

Why use a Plan Manager?

A Plan Manager is essentially a book-keeper.

Plan-Managed funding allows care recipients to hire non-registered supports, but without all the work of self-managed funding. With this option, recipients hire a plan manager to organise payments and store all records on their behalf. Similar to having their own personal book-keeper for their NDIS plan. There is also extra funding available to pay the plan manager so that money won’t be taken away from other supports. The only downside here is the NDIS won’t let recipients pay supports more than the price limit.

A great thing about being able to hire supports that are not registered with the NDIS is that it allows people to get more involved in their community. This is due to being able to use providers that don’t specialise in disability. If the care recipient has an unregistered NDIS provider in mind, then with plan-management or self-management the recipient can still hire them.

How do I report an incident?

It is important we know about any incidents (including near misses), so we can review the occurrence, actions, and future mitigations and look to improvements. Even if in doubt as to whether there was an incident or not, please complete this incident form:

How do I make a complaint?

Ideally send us an email, call us or complete this form in the first instance, you may be asked to clarify your issues, provide more information and discuss your expectations. Please provide as much information as you can when you lodge your complaint. This helps us to understand all the issues and determine the most appropriate way to resolve your concern.

At any time you may complain directly to the NDIS Quality and Safeguards Commission (NDIS Commission) by phoning 1800 035 544 (free call from landlines). Interpreters can be arranged. Web: https://www.ndiscommission.gov.au/about/complaints.

What is Self-Management?

Self-management will allow the care recipient to hire any provider. They do not need to be registered and can charge more than the hourly rate in the price guide. This means that literally anyone with an Australian Business Number (ABN) can be hired, even if they don’t have specialist disability experience. However, if a higher rate is paid the recipient will still need to make sure their budget will last the whole year. Due to the fact their budget only considered the NDIS hourly rates.

Some support providers have complained NDIS prices are set too low. Therefore, self-management is great if the care recipient wants to hire a provider that charges above the price limit. Buyer beware! Some providers charge the maximum price possible. They have little regard to what the fee should be delivering in terms of value and quality of service. When this happens, the recipient does not get value in their plan. Consequently, they lose hours of service and might have their self-management status reviewed.

Downside of Self-management

Another downside of self-managed plans is the administration, including, record keeping, segregating funds, claiming and paying providers. The care recipient is responsible for keeping records of every transaction on the plan for five years. If they lose a few receipts, or the ink on them fades away, there will be trouble if the agency decides to conduct an audit. While recipients can hire support to help manage their plan, this will come out of their budget. Overall, for people who don’t mind being their own accountant and who need to pay above the price limits, self-management is a good option.

Self-Management offers similar benefits to Plan Management, including greater control over day-to-day decision making, more flexibility, and greater choice in how to use the funding.

The key differences between Plan Management and Self-Management is that Self-Management:

- Do their own administration for claims and payments. Also, the NDIS participant is responsible for claiming NDIS funding and paying the invoices related to the products and services received through an NDIS plan.

- Can pay whatever they choose to service providers, and Plan Managers have prices caps, similar to Agency Management.

What is Agency Managed?

With agency management, the NDIS agency organises the financials for the plan. It’s the easiest option in terms of the extra administration work. This needs to be completed by the care recipient, but it’s also the most restrictive in their choice of support provider. In fact, only providers registered with the NDIS can be used on an agency-managed plan. However, if the plan only has a few providers that are all registered – and the plan is unlikely to change – agency-managed funding is a perfectly reasonable choice.

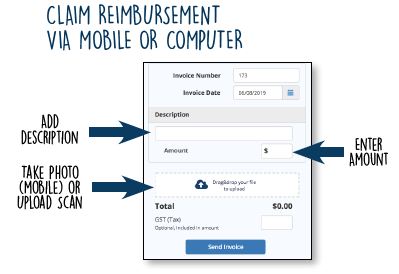

Reimbursements for Participants

Participants, who spend their own money, can request a reimbursement for expenses allowable in their NDIS Plan, these expenses are individually identified as reimbursements and sent to the NDIS to be paid overnight. It is the Participant’s responsibility to ensure reimbursements are allowable by communicating with their Plan Manager before their claim.

To setup an account, the participant needs to provide their bank details (BSB and Account) to Capital Guardians for deposits to be made by following this link: Reimbursement Account Form

After setup, the NDIS participant or their representative can claim the reimbursement by:

- Login to the Capital Guardians site using email address and password.

- In the menu on the left-hand side, select, “Invoice.”

- Enter the dollar amount claimed; description; date and attach the receipt (mandatory).

- Click on “Send”.

If claiming the reimbursement on a smart-phone, use the camera to take a photo of the receipt.

For participants who don’t have computers, reimbursements need to be organised with the representative or support coordinator. A process for providing paper-based requests and receipts will be setup.

We will complete this request within 2 business days and we will inform you via email of when this reimbursement account is created.

Please see reimbursement rules: Reimbursement rules.![]()

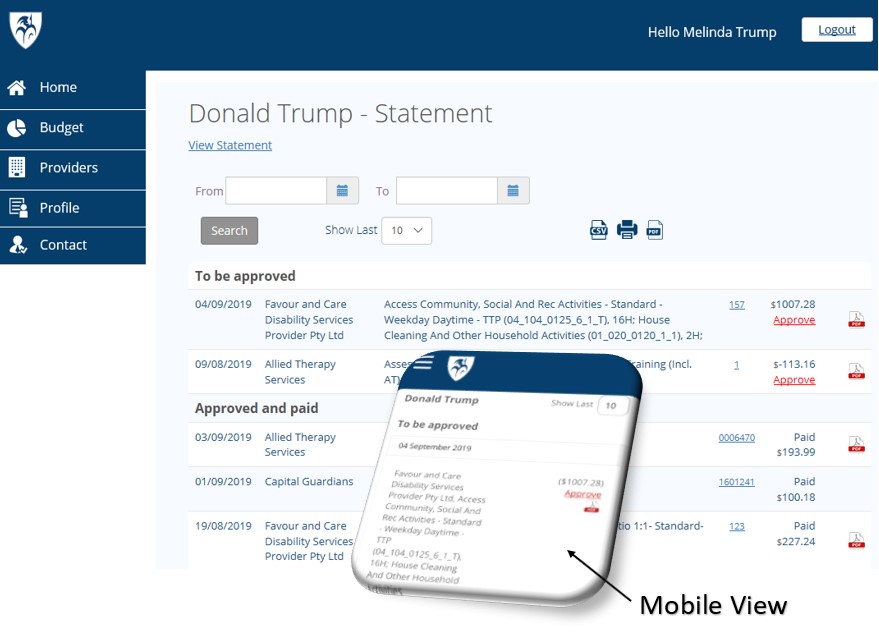

Approving invoices

A Participants Plan comprises funding that is their money. However, it is important this money is treated no differently to personal monies, and only spend when agreed goods and services are provided.

For this reason, all Capital Guardians accounts have a nominated “Approver”. (or more than one). As soon as an invoice is submitted by a provider (real time), an email to approve is sent. Thus, the approver can then approve on any desktop or iPhone, also review the actual pdf invoice and all its details.

As soon as an Approver logs in, just need to select the words “Approve” in RED, and the provider is paid the next working day.

If you do not approve the invoice, select the invoice number and either 1) type a message to the provider; or 2) delete the invoice and type a message to the provider why you are deleting.

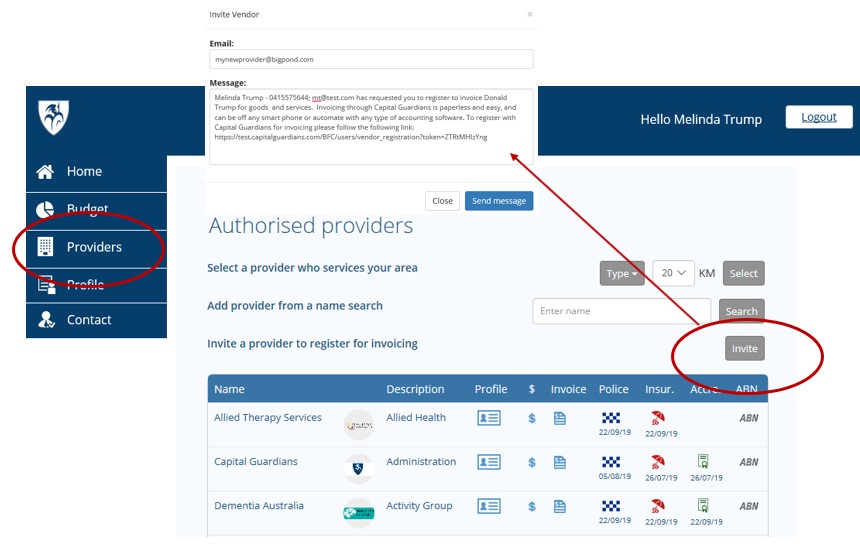

Getting Started

After registering, login and select the Providers tab. This allows a search of local providers within Capital Guardians. Alternately, just invite a provider to register with their email address.

You can choose any providers with an Australian Business Number (“ABN”). Anyone “carrying out a business” can apply for an ABN for free at https://www.abr.gov.au/business-super-funds-charities/applying-abn.

It only takes minutes for a Provider to register. The registration process will automatically confirm their ABN for your peace of mind. In addition, they provide you their police check and insurance covering: professional indemnity, public liability and personal accident insurance. (including journey insurance). Providers can upload their Police Check, Insurance and other forms, and can be seen in search and user logins.

This short video provides a basic overview on approving invoices and adding providers:

What happens when I choose Capital Guardians?

After NDIS providers give Capital Guardians the required details from their NDIS plan to create a service booking, we will provide them with the login details. These will be used to view information about the funding they have in their plan. We will also provide NDIS participants a link to share with their providers, allowing them to upload invoices for services provided.

When providers upload a bill, they want to be paid; the NDIS participant will be alerted through email. They can view and approve them, or engage in capacity building activities. Should something not appear correct, they are able to talk to us. NDIS participants have access to the details in their NDIS plan by logging into the Capital Guardians website at any time, providing information that is reconciled in real-time.

Registering with Capital Guardians

To be able to use Capital Guardians as an NDIS Plan Manager, you need to choose or have chosen Plan Management as an option. This should happen through your NDIS planning meeting. When you have Plan Management in your plan, then you can register with Capital Guardians via our website, or call or email us.

If your NDIS plan has no Plan Management, speak to your Local Area Coordinator or call the NDIS to ask for a review of your plan. This will allow the NDIS to change your plan to one that is Plan Managed.

NDIS participants or their representatives can visit the Capital Guardians website, call, or email us to begin working with us. When switching from a different Plan Management Provider, we can work directly with the NDIS participant to end their previous service bookings and create new ones.

What can participants use STA funds for?

STA stands for Short-Term Accommodation. The NDIS provides STA funds as a form of temporary respite care, allowing participants and their carers to spend some time away from the participant’s home.

The specifics of what can be claimed under STA must be reasonable and necessary as determined by the participant’s needs and goals, which must be clearly laid out in their Plan. In the absence of documentation provided in their Plan, participants should seek written guidance from their NDIA planner or Local Area Coordinator (LAC).

Do participants need to take out insurance for support workers?

If you engage carers and other support workers as independent contractors, you do not need insurance to cover them. As they are essentially a small business owner themselves, contractors have their own Australian Business Number and are responsible for managing their own insurance.

However, we advise participants that have carers coming to their home to verify their home insurance covers potential public liability for any visitors. This would be regarded as a personal expense and therefore not claimable under the NDIS, as it is something any homeowner might have.